when are property taxes due in illinois 2019

Conducts annual sale of delinquent real estate taxes. Sangamon County committed to moving due dates on property taxes to June 12 and Sept.

Welcome to Ogle County IL.

. If you are a taxpayer and would like more information or forms please contact your local county officials. Tax Year 2020 Second Installment Due Date. So in 2020 the house.

Im looking at the 2020 value and comparing them to 2019. The assessed value of my property jumped over 43500. The due date for the first installment of the property tax bill is coming up fast on june 3.

Tuesday March 2 2021 Late Payment Interest Waived through Monday May 3 2021 Tax Sales 2022 Scavenger Sale. Tax Year 2021 First Installment Due Date. It is managed by the local governments including cities counties and taxing districts.

Property Tax Second Installment Due Date. Press question mark to learn the rest of the keyboard shortcuts. Due dates are June 6 and Sept.

Visit your countys official website or Department of Revenue and make an electronic payment to avoid queuing and waiting. The Second Installment of 2020 taxes is due August 2 2021 with application of late charges moved back to October 1 2021. Prepare and file 2019 prior year taxes for Illinois state 1799 and federal Free.

173 of home value. Mobile Home Due Date. The only thing that happened was my parents transferred the title of the house to me.

Prior to 2019 the yearly jump was maybe 1000 or several hundred. The Illinois Department of Revenue does not administer property tax. 100 Free Federal for Old Tax Returns.

For now the September 1 deadline for the second installment of property taxes will remain unchanged. Tuesday March 1 2022. What caused it to jump so much.

Tax amount varies by county. General Information and Resources - Find information. Property tax due dates for 2019 taxes payable in 2020.

This filing and payment relief includes. Counties in Illinois collect an average of 173 of a propertys assesed fair market value as property tax per year. Under illinois law areas under a disaster declaration can waive fees and change due dates on property taxes.

Joe Sosnowski R-Rockford filed House Bill 5772 which calls for a 90-day delay without penalties on 2019 property tax payments which come due. Friday October 1 2021. Ad Prepare your 2019 state tax 1799.

2021 Real Estate Tax Bills. Billing and Collection of nearly 66 million real estate taxes. Are Illinois property taxes extended.

Tax Year 2020 First Installment Due Date. The filing and payment deadline for Illinois income tax returns has been extended from April 15 2020 to July 15 2020. 12 to give residents extra time to obtain unemployment stimulus checks or other relief.

Property Tax First Installment Due Date. Press J to jump to the feed. Monday February 14 through Tuesday March 2 2022 2019.

The first installment due June 1 will be accepted without late penalty interest payments if paid on or before July 1. The 2019 income tax filing and payment deadlines for all taxpayers who file and pay their Illinois income taxes on April 15 2020 are automatically extended until July 15 2020. Election Night Results Contact Calendar Agendas Minutes Maps Employment.

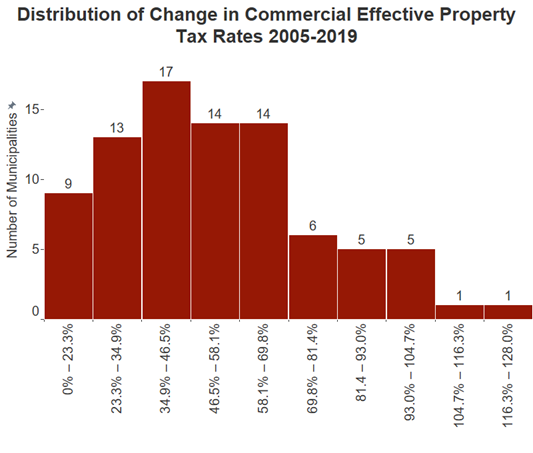

The median property tax in Illinois is 350700 per year for a home worth the median value of 20220000. While Illinois home values dropped property taxes increased by more than 51 alarming many homeowners. 2019 payable 2020 tax bills are being mailed May 1.

The property tax due dates are April 30 and October 1 for the first and second half instalment respectively. It is too early to determine the due dates for the 2021 real estate tax bills payable in 2022 but hopefully sometime in October and November will be the due dates. So property taxes are due.

When are property taxes due in illinois 2019 Sunday April 24 2022 Edit The phone number should be listed in your local phone book under Government County Assessors Office or by searching online.

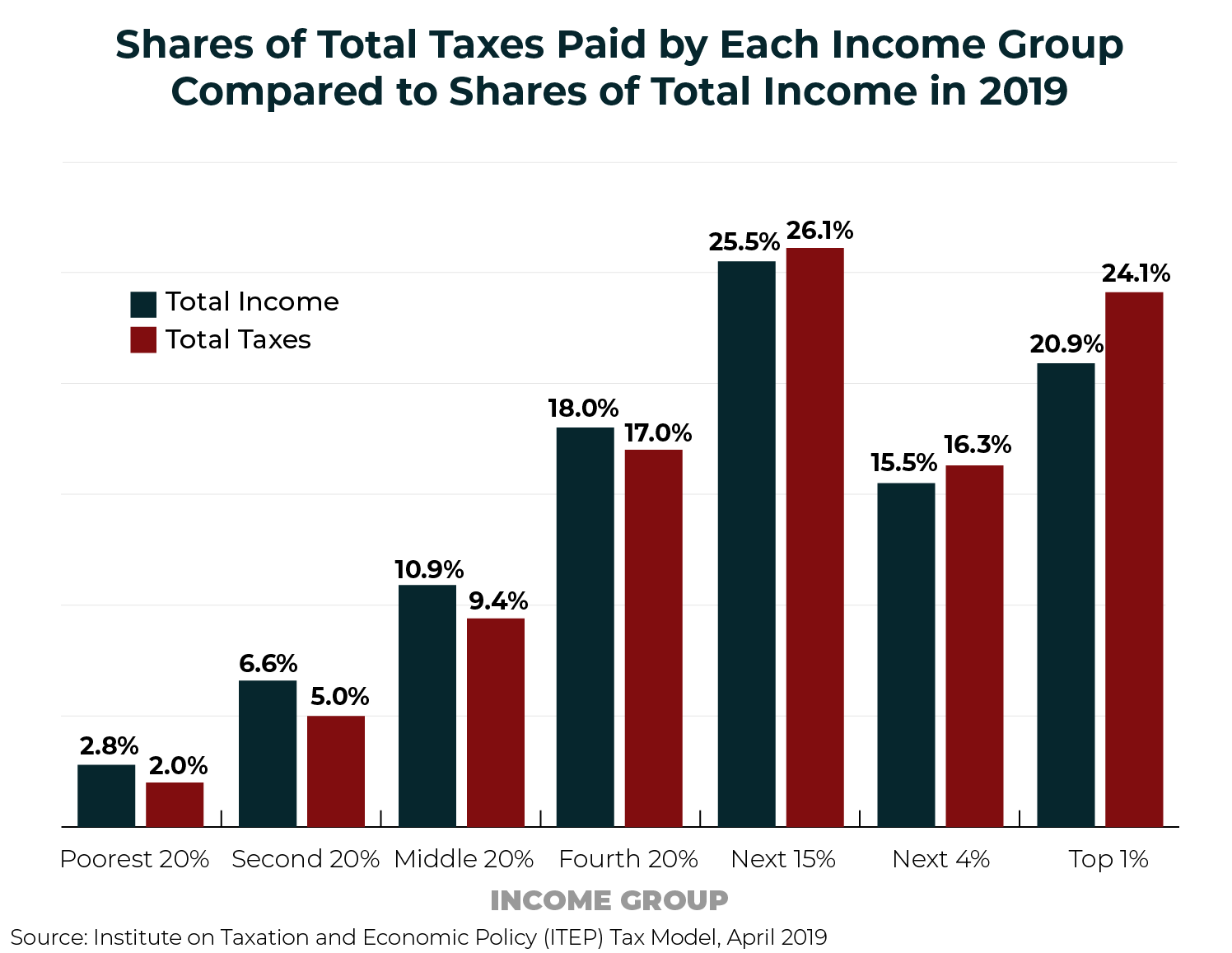

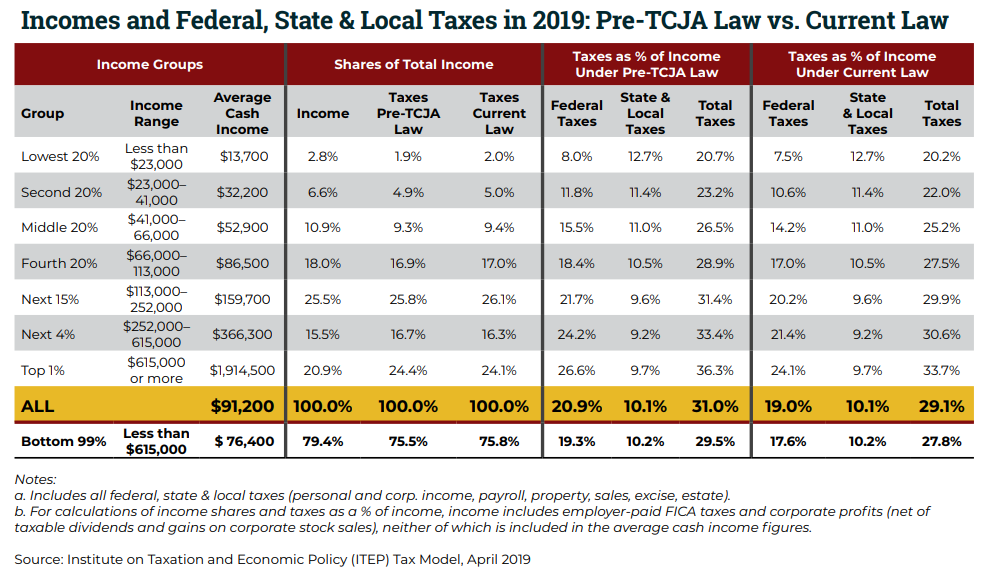

Who Pays Taxes In America In 2019 Itep

Illinois Income Tax Rate And Brackets 2019

:max_bytes(150000):strip_icc()/dotdash_Final_What_Tax_Breaks_Are_Afforded_to_a_Qualifying_Widow_Nov_2020-02-822f6b88f3fe437caed0b5ca5bc51bdf.jpg)

What Tax Breaks Are Afforded To A Qualifying Widow

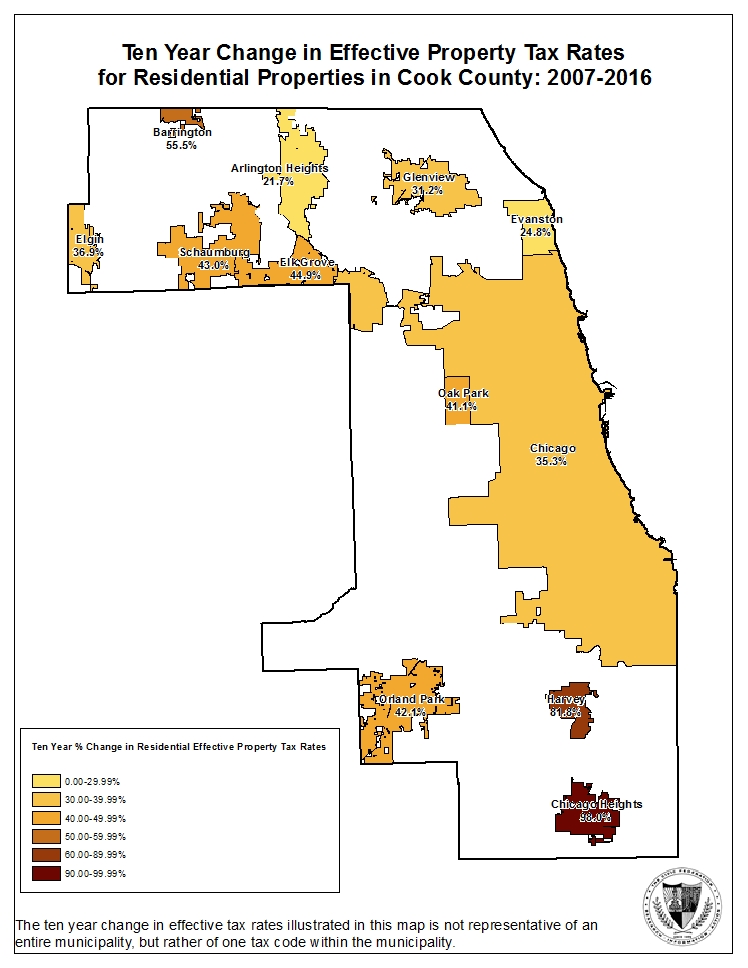

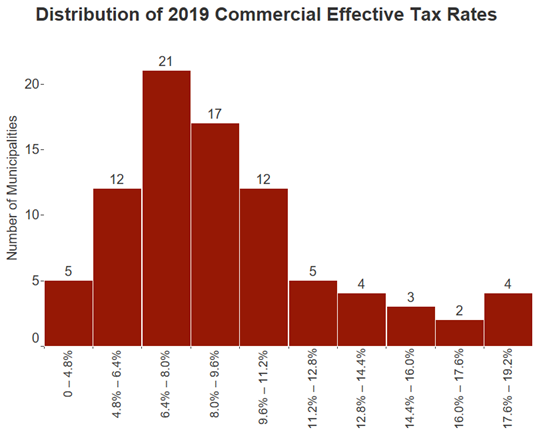

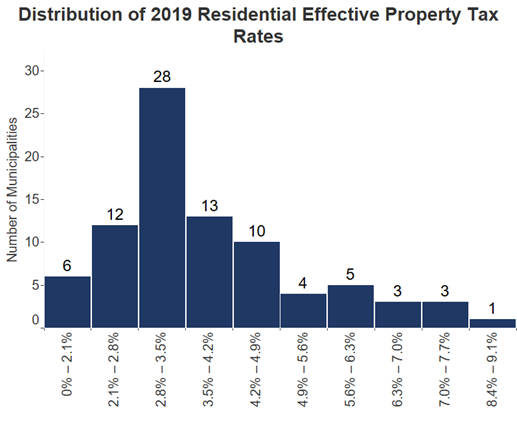

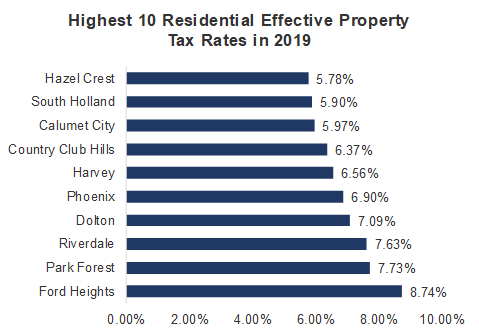

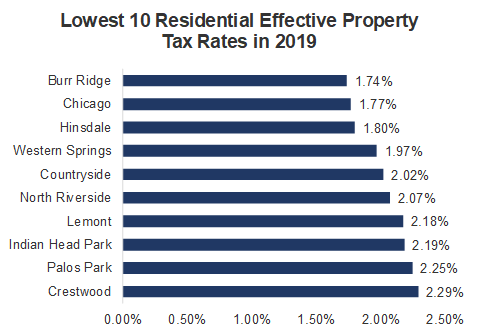

Ten Year Trend Shows Increase In Effective Property Tax Rates For Cook County Communities The Civic Federation

Primera Ins Tax Services On Instagram Tis The Season For Tax Preperation Did You Know The Easies Financial Institutions Tax Software Best Tax Software

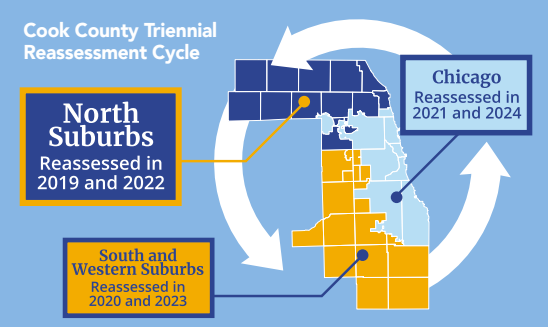

The Cook County Property Tax System Cook County Assessor S Office

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

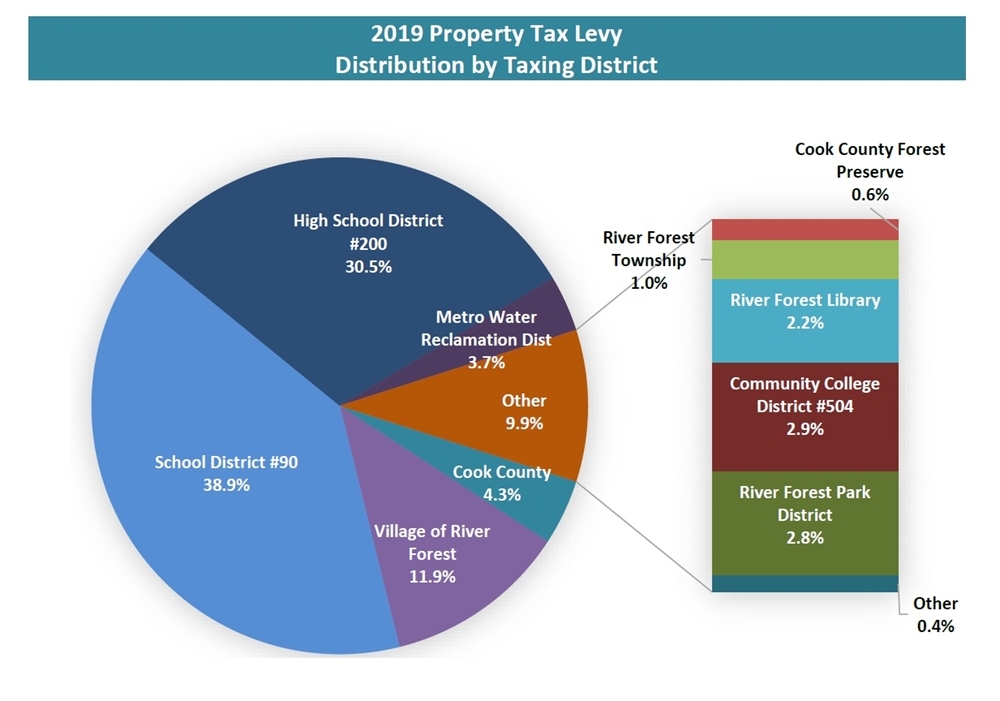

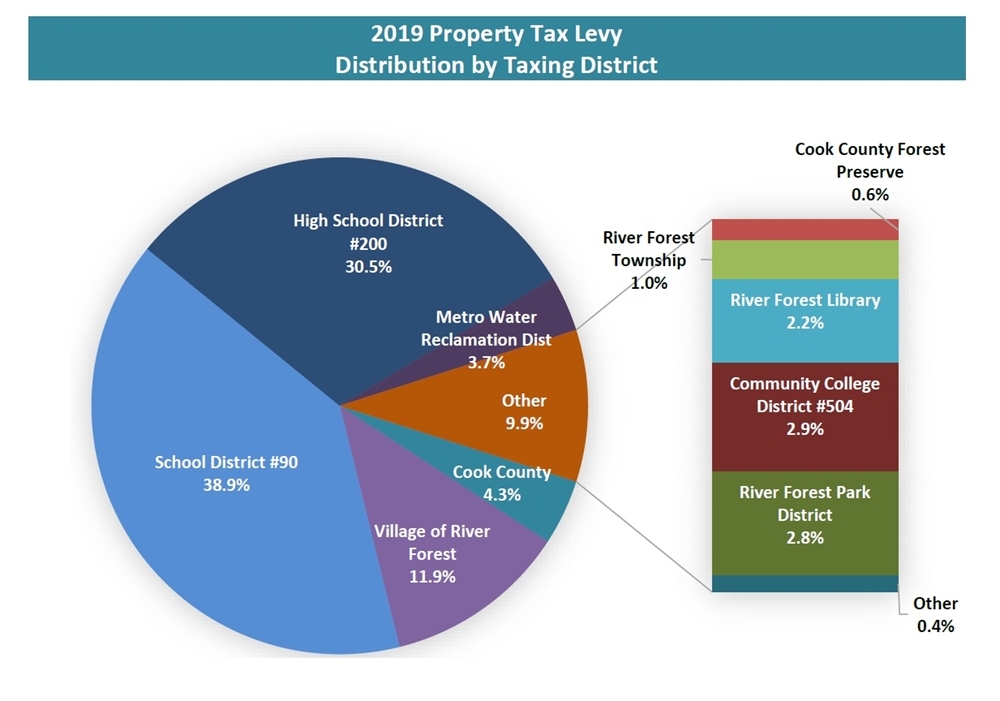

Tax Information Village Of River Forest

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

Montgomery County Courthouse Sign In Hillsboro Illinois Paul Chandler February 2019 Illinois Courthouse Montgomery County

Normal We Must Entertain And More Entertaining Government Organisation Community College

Who Pays Taxes In America In 2019 Itep

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Why Property Tax Reform In Cook County Is So Hard To Achieve Crain S Chicago Business

These Are The Best And Worst States For Taxes In 2019

Effective Property Tax Rates In South Cook County For Tax Years 2005 To 2019 The Civic Federation

The Shutdown Of Businesses Across The Country Is Casting A Pall Over A Segment Of The 3 9 Trillion Municipal Bond Market That Had B Sales Tax Tax Filing Taxes